A few years ago, I wrote an article about new project from AST Space Mobile which uses satellites to provide services to standard mobile telephones. Since then, a lot of progress has been made, but whilst satellite-based connectivity for standard mobiles is not yet fully mainstream, new services are getting closer as other tech companies also develop solutions. Based on what I have seen reported over the past year, we will not have to wait much longer for these new services, but availability in the “Global South” will take longer.

In February, The GSMA (trade association for mobile networks) will be holding its annual trade show called the Mobile Word Congress (MWC). In the lead up to MWC many network operators and handset makers use this event to launch new products and services. For 2024 we are already seeing plenty of announcements from the innovators planning direct to satellite to mobile services. More announcements may be in the pipeline, but currently I am aware of four direct mobile to satellite options emerging. Below we will explore four options. Two of these options rely on standard satellite signals and require compatible mobile phones. AST Space Mobile and StarLink use standard LTE/4G technology.

AST Space Mobile

AST Space Mobile was the first operators to go public with to promote direct to satellite LTE services. AST Space Mobile initially secured funding from the Vodafone group which is a multi-national company. Recently they announced further funding from AT&T and Google.

AST tested its Blue Walker-3 satellite in April 2023 with the first call being made from Texas USA to the Rakuten Group in Japan using a standard Samsung S22 Android mobile.

Already, the company has agreements and understandings in place with around 40 partners including Orange, Telefonica and MTN, although it is expected that the first commercial operations are likely to be launched in the USA. The appearance of MTN in the partnership list will be good for Africa as MTN is a major player in many countries throughout Africa. The commercial work with the AST network appears to be the most advanced at this time, but SpaceX with its StarLink network could accelerate its partnership model quickly.

Iridium

As a long-established satellite telephone operator, Iridium has had a bumpy start in its direct to mobile roadmap when its partnership with the chip maker Qualcomm failed. They have launched Project Stardust which will be based on open standards. Unlike the full LTE functionality offered by AST Space Mobile, Project Stardust uses standard L Band channels and will be initially limited to SOS and SMS text services with data arriving in the future. In addition to smartphones, the service is being designed so that it can be accessed by smaller devices like smart watches. Iridium plans to start testing in 2025 and then launch a commercial service in 2026.

Whilst this innovation is planned to be a direct mobile to satellite service, it does rely on a bespoke chipset being added to each handset. Whilst the tech is “Open sourced” the service will not be LTE/4G compatible but will operate direct on the Iridium L Band. There is an advantage to this approach as it uses the standard Iridium frequency spectrum and will be easier to roll out globally as there are less regulatory challenges.

StarLink

SpaceX is possibly now the largest operator of satellite globally and well known for its StarLink internet service. Whilst StarLink has focused on its low-cost internet services, in January 2024, they tested services via one of their new and recently launched LTE/4G capable satellites and early testing is showing some great results. Very soon, text services will become available and in 2025, services will be expanded to data and voice. As this service is LTE/4G technology based, services can be accessed by any standard smartphone if the SIM card is registered to a telecoms partner like T-Mobile (USA), Salt (Switzerland). To date, there does not appear to be any global south partners but given that StarLink is operating in many Global South but this could change in the months ahead.

Apple

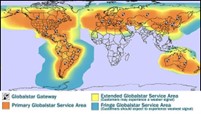

With the launch of the Apple iPhone 14, Apple included a basic satellite SOS function via the GlobalStar satellite network. The Apple approach is not LTE based, but still useful for people who may be in distress in remote locations. Apple is working with GlobalStar to provide internet access in the future. Whilst the SOS function is very useful, Apple technology is very expensive and the GlobalStar network is limited to the Americas, Europe Australia and parts of Asia and the Middle East. Apple satellite SOS will not work in most parts of Africa.

Is this new approach a game changer?

The answer is a definite yes! But it’s important to weigh up the various options before selecting any of the technologies. The best option to select will depend on where the technology will be used and what functionality will be required. Currently the Apple SOS feature is free of charge but likely to become a pay for service after the end of 2024. This service would be an excellent choice for people who occasionally venture into remote locations in developed countries, but the iPhone 14 or newer is needed. The Apple / GlobalStar service is the only Direct satellite service operating at this time.

Iridium will be a good option as its global and provided by a well-established global satellite network. Whilst Iridium is promoting open standards, unfortunately to access this service, phones need to be sourced that has the compatible technology built in. When available Iridium could be the best alternative to buying a standard satellite telephone. In the International Aid sector, when Iridium goes live, this option could be my first choice for security telecoms.

Finally, we are left with StarLink and AST Space Mobile which is pure direct to satellite LTE/4G services. In a nutshell, these services will be compatible with any standard GSM phone. Based on current announcements from these operators, services can only by bought through a national telecoms partner. From a “Security Telecoms” point of view, for now we must assume that telecoms operators in some countries could be forced to disable services by local governments in the same way as they do for terrestrial networks. So, for now, it’s important not to give up traditional satellite telephones such as Inmarsat, Iridium and Thuraya.

Longer term, it is likely that Direct Satellite to Mobile will get through the various regulatory challenges and could push traditional satellite operators aside. Out of the big three, Iridium is in a good place for the new services, but Inmarsat and Thuraya are unlikely to be offering LTE services from their GEOS fleet and there orbits are significantly higher.

Conclusion

Direct to satellite services (LTE/4G) is a rapidly evolving sector. Apple is the only technology with a live service now and limited to SOS SMS only via a app. As the technology evolves, so will the regulatory challenges. The global mobile sector is massive and well-financed and would object to satellite operators joining the business as competition. Some mobile networks are owned by national government who would impose bans on this new tech if it were to threaten revenues. Currently the emerging business models seem to be based on partnerships where national telecoms providers work with the satellite operators to provide roaming options to extend terrestrial service into remote and rural areas. My gut feeling is that StarLink has the funding and capacity to deliver services at scale and most likely to emerge as the leading direct to satellite LTE/4G provider within the next three years.